The cost of living rose by an average of 7.4% worldwide in 2023.1 Against this backdrop, how can organizations surpass the significant challenges in crafting effective expatriate compensation strategies, that both attract and retain top talent while controlling costs? This blog post explores the advantages of adopting a hybrid compensation approach, leveraging the U-Calc method to seamlessly calculate gross salaries in host countries with varying tax regulations, all while maintaining employee net pay and reducing tax complexities. The Equus Tax Engine emerges as a powerful solution for automating these calculations, offering organizations a way to save both time and money in their global mobility programs.

The Challenge of Expatriate Compensation

The rising cost of living around the world is forcing companies to reevaluate their expatriate compensation strategies. As talent acquisition and allocation become increasingly global, organizations grapple with the dual challenge of attracting and retaining top talent while managing administrative and operational costs.

For instance, consider a Swiss-headquartered company based in Zurich – a high-pay location – that needs to staff a temporary project in Bangalore, India, a lower-pay region. How can the company design compensation packages that incentivize their HQ talent to relocate to Bangalore without incurring prohibitive costs, and ensure a smooth transition back to Zurich upon project completion?

Comparing Home- vs. Host-Based Compensation Models

Home-Based Compensation Model

A home-based policy ensures that expatriates retain their home country’s take-home pay, providing financial stability and continuity. However, this approach can significantly increase employer costs due to higher salary benchmarks and introduce complex tax and payroll challenges.

Host-Based Compensation Model

Conversely, a host-based model aligns expatriate salaries with local market rates, simplifying payroll compliance and ensuring pay parity with local employees. While this approach reduces administrative burdens and costs, it may deter employees from accepting assignments if the host country’s compensation is markedly lower than their home country’s, leading to difficulty filling the roles.

The Hybrid Compensation Approach

To overcome the limitations of both models, organizations are increasingly adopting a hybrid compensation strategy. This approach combines elements of both home-based and host-based models, offering a balanced solution that caters to both employer cost-efficiency and employee financial satisfaction.

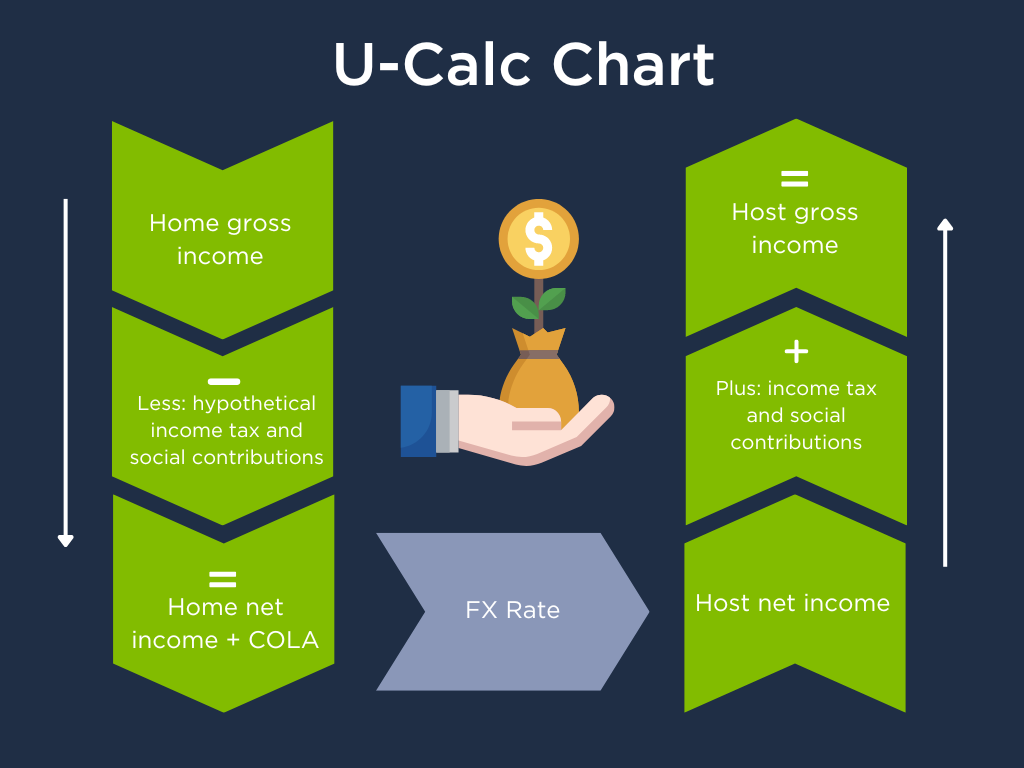

Why Hybrid Compensation Works: Leveraging the U-Calc Method

Known variously as U-Calc, salary build-up, or gross-to-net-to-gross calculations, the hybrid approach is a growing trend in global mobility for a reason – it offers multiple benefits to both employers and employees. The U-Calc uses the home country gross salary as a starting point to calculate a gross salary in the host country. It maintains the employee’s home net pay, while factoring in the differences between the home and host tax systems. This method streamlines processes and offers many benefits for both employers and employees. Keep reading to learn more about the advantages.

Key Benefits of U-Calc Method for Employers and Employees:

Key Benefits for Employers:

- Substantial cost savings due to elimination of gross-ups and recalculations

- Administrative benefits through streamlining processes

- Facilitates employee repatriation without the need for tax reconciliations

- Reduced reliance on tax provider services

Key Benefits for Employees:

- Eliminates financial concerns about repatriation when cost of living is higher in home country

- Ensures home country pay is maintained and even increased in line with home country market

- Removes the need for pay negotiation upon repatriation

By utilizing U-Calcs our Swiss HQ company is able to populate their project in Bangalore with highly skilled HQ resource, whilst eliminating the need for complex payroll grossups, tax equalization reconciliations, sidestepping the tax settlement process – all at the same time as maintaining the employee’s Home pay. The employee benefits from the security of knowing they will continue to receive their Home net pay, increased to compensate for any additional tax relating to their move. In addition, they will have the comfort of knowing their Home pay will keep track with their peers throughout the project, smoothing their transition Home after project completion.

How the Equus Tax Engine Can Simplify Your Hybrid Compensation Policy

Implementing a hybrid compensation policy offers a balanced solution for managing expatriate roles in diverse economic regions. However, the complexity of navigating multiple tax jurisdictions necessitates a robust and reliable tool. This is where the Equus Tax Engine excels. If a hybrid compensation policy is part of your current global mobility program, or if your company is considering adopting it, the Equus Tax Engine is well-positioned to provide the necessary calculations at the click of a button.

Why Choose the Equus Tax Engine?

With a baseline template pre-configured to support these calculations, you could be utilizing the tool within as little as 30 days. You can count on the Equus Tax Engine for accurate calculations, as our internal team of tax professionals works full-time to maintain it.

Take the Next Step with Equus

Are you looking to revolutionize your global tax management process? The Equus Tax Engine is the solution you’ve been searching for, providing support for a wide range of tax policies to ensure efficiency and accuracy.

- See the Tax Engine in action – Request a Demo

- Have questions? Contact Us

- Learn more about the tax engine, read some of our blogs: