Don’t Get Caught Out By Permanent Establishment Rules

Click Here to learn more about the PinPoint Posted Worker App.

How to make sure your business isn’t caught out by permanent establishment rules

When an employee is working in a country where the employer does not have an entity, the company can sometimes have a corporate tax liability in that country just because of that single employee. Being caught out by these ‘permanent establishment’ rules can mean a  corporate tax liability for the employer. The precise definition of a permanent establishment varies between countries and income tax treaties. The OCD model convention, article 5 states:”A Permanent Establishment is a fixed place of business through which the business of an enterprise is wholly or partly carried on.”

corporate tax liability for the employer. The precise definition of a permanent establishment varies between countries and income tax treaties. The OCD model convention, article 5 states:”A Permanent Establishment is a fixed place of business through which the business of an enterprise is wholly or partly carried on.”

Typically, a tax treaty defines a PE using the following two general tests:

- Whether the corporation has a fixed place of business within the target country, as defined under the language of a specific treaty.

- Whether the corporation operates in the target country through a dependent agent that habitually exercises the authority to conclude contracts on behalf of the corporation in the target country.

As travel restrictions are lifted, and businesses begin to move talent around the world to remediate, reform or grow parts of their operations, the risks of falling foul of permanent establishment rules are heightened. That companies expect more flexible working and overseas remote working in a post-pandemic world also creates new risks.

When is an establishment ‘permanent’?

Whether or not the permanent establishment rules apply depends on a number of criteria: the type of work being done; whether the employee has authority to sign contracts; duration of activities, whether a business has a permanent place of work (e.g. a shop, a quarry, or a mine), or whether it regularly carries out work through agents. It also depends on the rules of the country in question, the relevant treaty, and on domestic law.

Corporate tax liabilities can be based on the company’s revenues or profits and are not limited to the employee’s salary, meaning that the tax liability can be high if not managed properly. In addition to the unexpected tax costs and reputational damage, a breach of permanent establishment rules can lead to increased audits eating up senior management time, increased reporting obligations, closer scrutiny of payroll, social security and immigration status, the restating of accounts, and other unwelcome attentions, ranging from the inconvenient to extremely serious.

Corporate tax liabilities can be based on the company’s revenues or profits and are not limited to the employee’s salary, meaning that the tax liability can be high if not managed properly. In addition to the unexpected tax costs and reputational damage, a breach of permanent establishment rules can lead to increased audits eating up senior management time, increased reporting obligations, closer scrutiny of payroll, social security and immigration status, the restating of accounts, and other unwelcome attentions, ranging from the inconvenient to extremely serious.

“What upsets business leaders most about breaches of the permanent establishment rule is that they are mostly completely avoidable, and are at heart failures of compliance,” said Scott Turner, Director of Product Marketing at Equus Software.

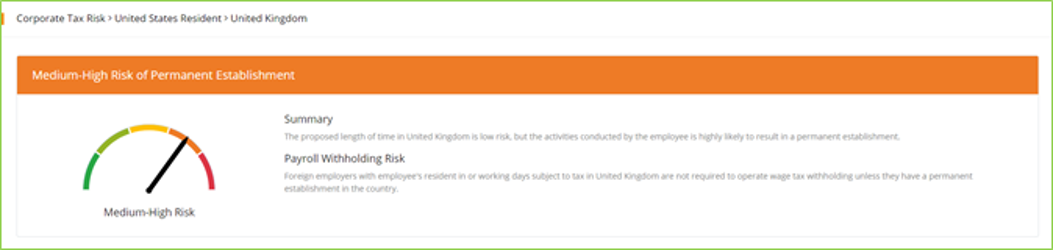

The risks of permanent establishment should be assessed for each trip or assignment, and companies need a system to judge with confidence whether the employee being in that country creates a permanent establishment risk.

How does PinPoint help with permanent establishment?

The PinPoint Posted Worker Tool allows companies to reduce the risk of creating a permanent establishment in a country without realizing by:

- Performing a pre-travel permanent establishment risk assessment for business travellers and remote workers. This takes into account the type of activities performed, income tax treaty specifics vs. domestic law, and the duration of time spent in the country.

- Allowing organizations to monitor the global employee population’s presence in countries.

- Highlighting countries where work is carried out above the threshold level.

Permanent establishment and Covid-19

One of the many changes wrought by the pandemic is the striking increase in remote and hybrid work. Indeed, many business leaders now talk openly of a newly distributed workforce and permanent change.

Another element business leaders, mobility and compliance teams should be mindful of is the increased controls from individual country tax authorities as they seek ways to more aggressively collect taxes to bolster their economies. And the increase of remote workers itself has pushed countries to audit and check worker status more frequently.

Don’t get caught out by permanent establishment post pandemic. Learn more about how technology can help manage and mitigate risk today.