Curious about upcoming tax updates in the Equus Tax Engine? Interested in learning about proposed tax legislation that could affect supported countries? Visit the Equus Tax Engine Help Center for answers to these questions and more to stay informed.

Upcoming Tax Updates

Keeping the Equus Tax Engine current is a continuous task. Our internal tax team monitors tax legislative updates using a combination of primary and secondary sources. When updates are enacted, we schedule the change into an upcoming release close to the effective date. These upcoming changes for key authorities are published in the help center, and organized by three primary components: legislation, updates, and new features.

- Key Countries’ Proposed Tax Laws – Stay up to date with important tax law changes in various countries with Equus. Visit the help center for a list of impactful legislation we are tracking, proposed effective dates, and our timeline for implementing changes in the Tax Engine.

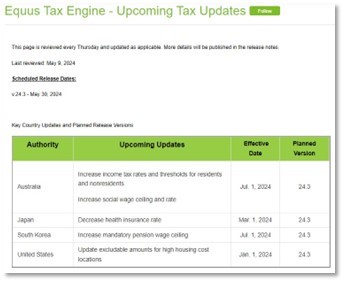

- Key Country Updates and Planned Release Versions – Once proposed legislated changes are enacted, this table provides a snapshot of when specific updates are planned for the most-used countries.

- Key Feature Updates and Planned Release Versions – In addition to keeping the tax engine current, we continue to add functionalities. This section highlights valuable features planned for upcoming releases. You can find a list of the latest enhancements, such as adding a new tax authority or a new tax component.

Annual Review Plan

In addition to updating the Tax Engine to incorporate new tax legislation and feature enhancements, the Tax Team also performs an Annual Review of every supported country. Once a year, we scrutinize each country, including focus and recurring topics. This process supplements our continuous Tax Monitoring process, which identifies and anticipates changes announced by tax authorities. Countries are scheduled for Annual Review based on tax year, usage, and geography. We update this page every year to share our plan, scheduled by release.

Who’s It for?

The Help Center offers quick updates for any users. Whether you are a compensation administrator wanting to anticipate which release a recently enacted change will be delivered in, or a cost estimate user wanting to know about feature updates, we’ve got you covered. Users may be especially interested in checking the Help Center in the fall, when many tax authorities progress their legislative processes for the upcoming year’s tax changes.

Staying Current

Equus updates the Upcoming Tax Updates page every Thursday afternoon, Mountain Standard time. Bookmark Equus Tax Engine – Upcoming Tax Updates in the help center for easy reference!

The Tax Engine currently covers 223 authorities, spanning across 153 countries, 50 American states, Washington, D.C., 10 Canadian provinces, and 9 Swiss cantons. We are happy to announce that Bosnia and Herzegovina will be added as our 224th authority in the upcoming July release.

Scheduled updates for the Equus Platform occur six times a year on the last Thursday of odd-numbered months. If a significant update is announced between these scheduled releases, it will be included in an interim release and shared on the Upcoming Tax Updates help center page.

Have Questions? Contact Us or reach out to your Global Client Success team for more information.