GLOBAL COMPLIANCE

Stay Confident and Risk Free

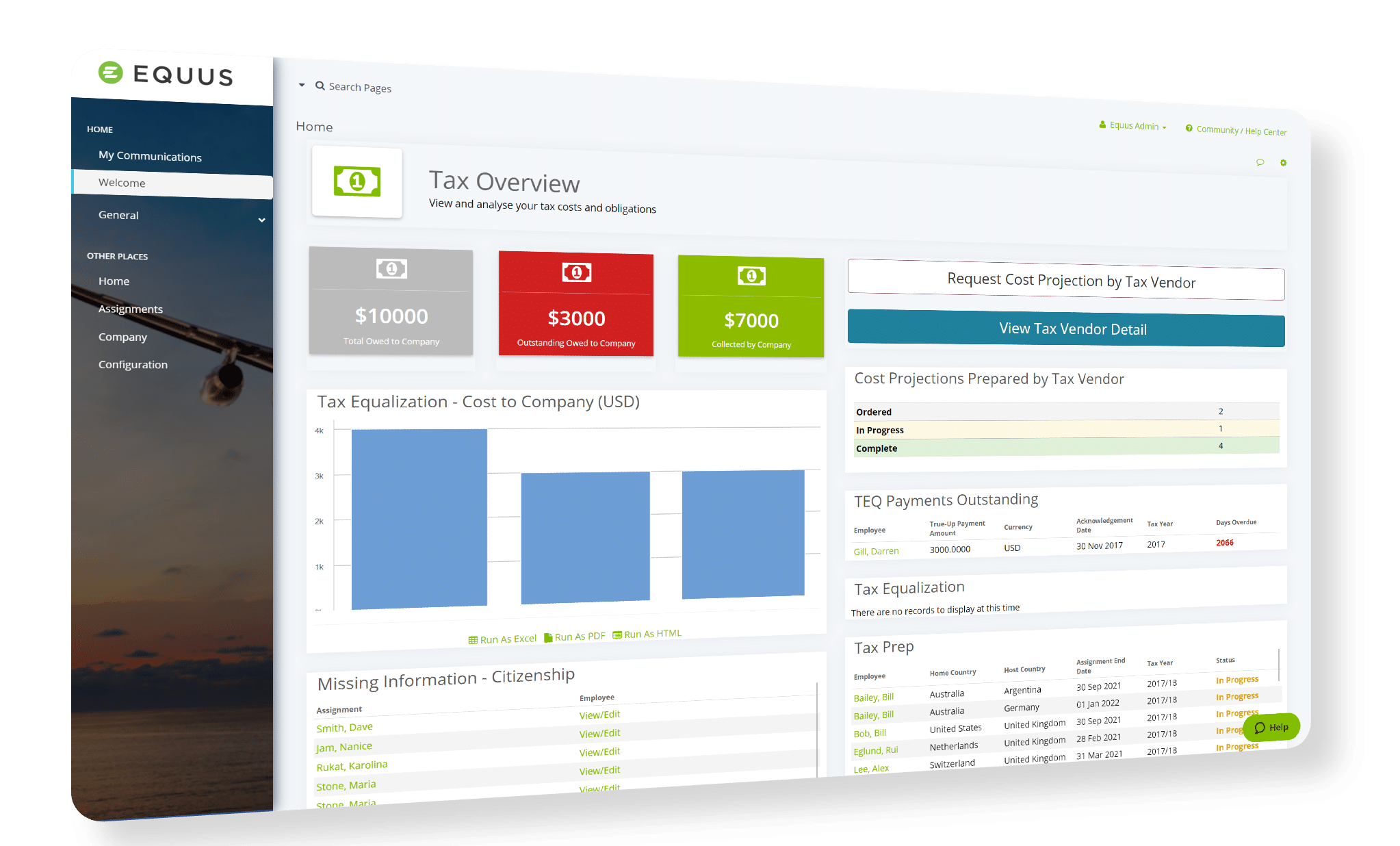

Equus's Global Tax and Compliance Engines help you mitigate risks and ensure smooth operations for your international workforce.

Mitigate risks and ensure smooth operations for your mobile workforce.

The Equus Tax Engine

Understand the tax implications of every move.

The Equus Tax Engine powers cost estimates, balance sheets, and compensation calculations to help you mitigate financial risk, eliminate surprises, and stay compliant. It supports all types of tax policy, from hypothetical taxes for tax equalized policies to gross-up taxes for host-based and permanent moves, and everything in-between.

Authorities

Provinces

Cantons

Experience You Can Rely On

Our in-house team of tax professionals continuously monitor, enhance and update the Engine to reflect current tax law in authorities around the world. With over 100 years of combined tax experience and a number of professional qualifications including American CPA, British CA and ITP, and Canadian CPA-CA, our team has the expertise needed to interpret complex tax issues promptly and deliver great tax software fast.

Global Risk and Compliance

Keep your mobile workforce safe and free of risk.

As compliance demands around international business travel and mobility become more complex, companies are under increasing pressure to accurately track, manage and support staff as they move around the world.

The Equus Platform gives companies a simple and reliable way to manage corporate risk - from regularly updated information around health and safety situations to changing tax and immigration regulations.

Assess Your Risk

Restricted Locations

Social Security

Posted Workers

Payroll

Personal Taxes

Employment Law

Permanent Establishment

Experience Peace of Mind with Equus.

Embrace a risk-free mobility journey with Equus's Tax and Compliance Engines.